Why Companies and Investors Need More Liquidity Strategies as Firms Stay Private Longer

It’s clear we’re living through a volatile time in the financial markets. Generally speaking, notwithstanding recent public market performance, we believe investor confidence has been waning for conventional opportunities, such as public equities and fixed-income investments, in part due to this turbulence and the low (and, in some countries, negative) interest rate environment, but also as a consequence of how efficient these markets have become over time. In addition to the short-term impact, this dynamic has increased investors’ longer-term concerns regarding performance. These realities have been generating greater interest in alternative asset classes (such as the private market) as a strategy for portfolio diversification and potential performance. Many of the advisors with whom I’ve recently met have expressed excitement over new tools to manage wealth for their client bases in ways that that they haven’t been able to in the past, in large part due to the burgeoning growth and evolution of the private market and, more specifically, the secondaries market.

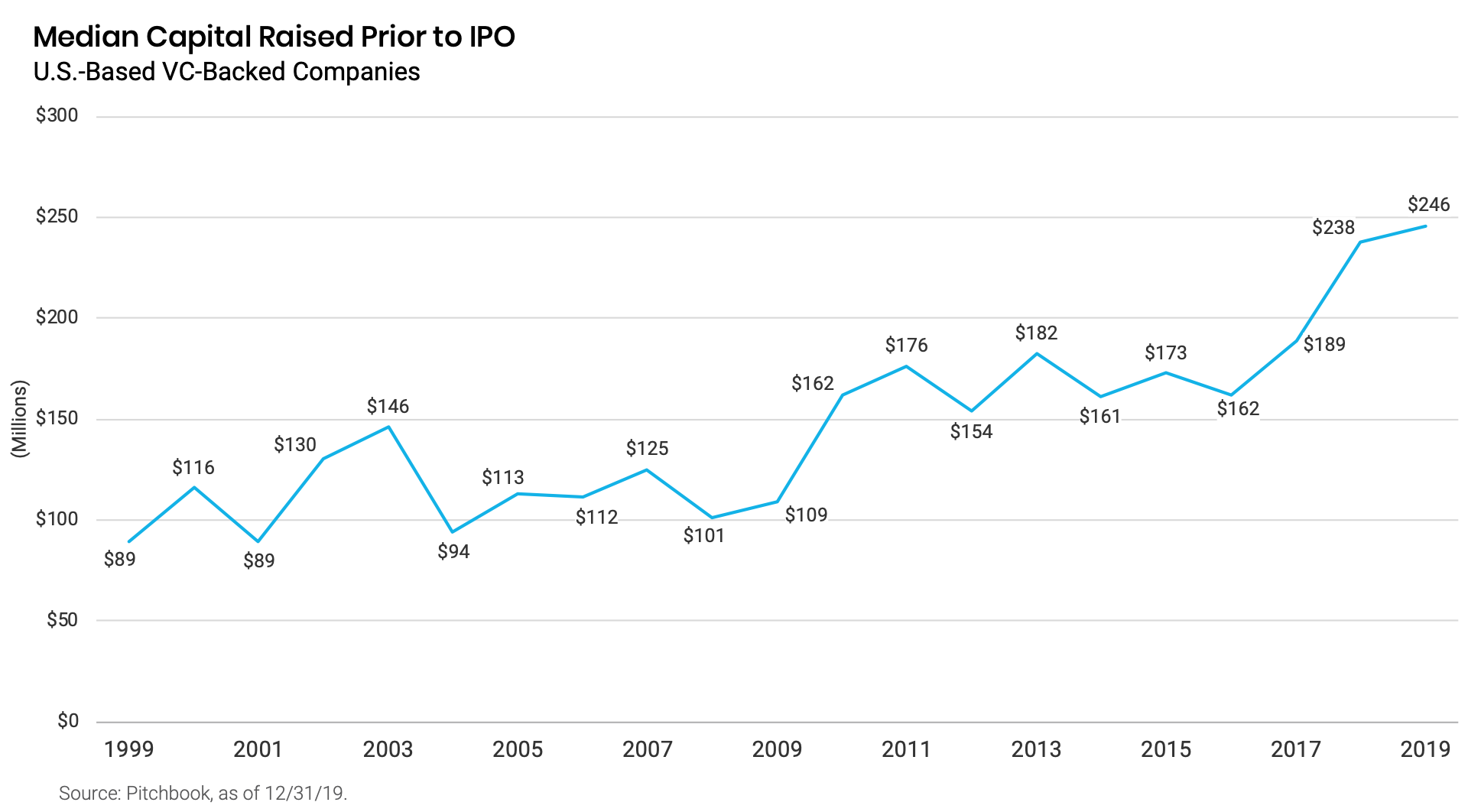

At the same time, many of the most innovative private companies today (including “unicorns,” or private companies with billion-dollar-plus valuations) have been staying private for longer. This protracted lifecycle is driven by three main reasons, as I outlined in a previous post. First, regulatory changes have made it more challenging and administratively burdensome for companies to go public. Second, growth-oriented companies are often still developing their business models and auditing their product sets, which may result in higher volatility if implemented in the public markets. Third, the amount of private capital available to companies has surged as investors’ concerns around performance from the traditional equity markets have escalated. The median amount of capital raised by a company prior to an IPO has swelled from $89 million in 1999 to $246 million in 2018.

While access to capital is not the only issue at hand when private companies contemplate delaying their exits, it is vital in order to continue investing in product development and to fuel growth as many of these companies are not yet profitable. This delay in pursuing IPO or M&A exits also creates friction within the capital structure of the private companies themselves, as both early investors and employees may not be well aligned or financially able to remain illiquid for an extended period of time. Furthermore, this delay creates friction within the underlying venture capital funds and for the general partners (GPs) managing them, as the funds may run out of capital to help protect their investments, exceed their stated lives, and face pushback from underlying limited partners (LPs) that may not have the patience to wait longer for the opportunity for the VC investments to be harvested and may not be as willing to invest in the GP’s next fund.

If we look back to the 1990s, some of the original secondary transactions involved LPs in funds seeking liquidity for their LP interests. Since then, demand for liquidity has only grown throughout the private market ecosystem, driven not just by LPs, but also by the needs of GPs seeking liquidity solutions for their fund structures and portfolios as well as portfolio company boards and management teams seeking partial to full liquidity solutions for investors and employees. In other words, the growing need for liquidity solutions throughout the ecosystem has resulted in a market with a variety of underlying investment strategies that may differ in terms of target transaction types, transaction sizes, asset stage, geography, return profiles, etc. When I joined the secondaries market in 2005, there was roughly $6 billion of reported annual transaction volume, of which the vast majority involved traditional purchases of LP interests. In 2018, that figure had surged to $70 billion, of which roughly one-third involved more complex, non-traditional LP-interest-driven volume. This year, credible sources, such as Greenhill Cogent, Evercore, Setter Capital, estimate that secondaries market volume may reach around $100 billion, and the percentage of non-traditional volume has continued to grow.

While the expansion of the secondaries market has created a variety of liquidity strategies for the various participants in the private market ecosystem, it has also helped spur attractive investment opportunities and dedicated strategies for investors to consider, such as the SharesPost 100 Fund, a closed-end interval fund. In a market where the average age of venture-backed technology companies achieving IPOs has lengthened dramatically—from four years in 1999 to 13 years in 2018—while average valuations have increased by about 300 percent in the same interim1, there are more opportunities to invest in late-stage private companies later into their development and prior to a potential IPO or M&A exit. The SharesPost 100 Fund’s strategy seeks to capitalize on this shift and provide investors access to these late-stage private growth companies before they potentially become available in public markets or are acquired. Also, by aiming to invest later in the companies’ life cycles (we target companies that we believe have an exit path via IPOs or M&A within a two-to-four-year timeframe), the SharesPost 100 Fund’s investment strategy can also seek out underlying investments with potentially shorter holding periods.

SharesPost helps enable both buyers and sellers of private assets to realize new avenues for a measure of liquidity in the face of changing public and private markets. As investors seek to diversify their portfolios into private market strategies while private market actors search for fresh sources of capital, there is now an option for accredited and non-accredited investors to tap into late-stage, high growth private companies that were long only accessible to institutional venture-capital and private-equity funds.

1 Source: Initial Public Offerings: Updated Statistics, Jay R. Ritter, Cordell Professor of Finance, University of Florida.

Important Disclosure

As of December 9, 2020, Liberty Street Advisors, Inc. became the adviser to the Fund. The Fund’s portfolio managers did not change. Effective April 30, 2021, the Fund changed its name from the “SharesPost 100 Fund” to “The Private Shares Fund.” Effective July 7, 2021, the Fund made changes to its investment strategy. In addition to directly investing in private companies, the Fund may also invest in private investments in public equity (“PIPEs”) where the issuer is a special purpose acquisition company (“SPAC”), and profit sharing agreements.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus with this and other information about The Private Shares Fund (the "Fund"), please download here, or call 1-855-551-5510. Read the prospectus carefully before investing.

The investment minimums are $2,500 for the Class A Share and Class L Share, and $1,000,000 for the Institutional Share

Investment in the Fund involves substantial risk. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. The Fund has no history of public trading and investors should not expect to sell shares other than through the Fund's repurchase policy regardless of how the Fund performs. The Fund does not intend to list its shares on any exchange and does not expect a secondary market to develop.

All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Fund's outstanding shares at NAV to be redeemed each quarter. Due to transfer restrictions and the illiquid nature of the Fund's investments, you may not be able to sell your shares when, or in the amount that, you desire. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. Because most of the securities in which the Fund invests are not publicly traded, the Fund's investments will be valued by Liberty Street Advisors, Inc. (the "Investment Adviser") pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees. While the Fund and the Investment Adviser will use good faith efforts to determine the fair value of the Fund's securities, value will be based on the parameters set forth by the prospectus. As a consequence, the value of the securities, and therefore the Fund's Net Asset Value (NAV), may vary.

There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments in a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities that could adversely affect the Fund’s performance. The Fund's quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so and may also result in an increase in the Fund's expense ratio. Portfolio holdings of private companies that become publicly traded likely will be subject to more volatile market fluctuations than when private, and the Fund may not be able to sell shares at favorable prices, such companies frequently impose lock-ups that would prohibit the Fund from selling shares for a period of time after an initial public offering (IPO). Market prices of public securities held by the Fund may decline substantially before the Investment Adviser is able to sell the securities.

The Fund may invest in private securities utilizing special purpose vehicles ("SPV"s), private investment funds (“Private Funds”), private investments in public equity ("PIPE") transactions where the issuer is a special purpose acquisition company ("SPAC"), and profit sharing agreements. The Fund will bear its pro-rata portion of expenses on investments in SPVs, Private Funds, or similar investment structures and will have no direct claim against underlying portfolio companies. PIPE transactions involve price risk, market risk, expense risk, and the Fund may not be able to sell the securities due to lock-ups or restrictions. Profit sharing agreements may expose the Fund to certain risks, including that the agreements could reduce the gain the Fund otherwise would have achieved on its investment, may be difficult to value and may result in contractual disputes. Certain conflicts of interest involving the Fund and its affiliates could impact the Fund’s investment returns and limit the flexibility of its investment policies. This is not a complete enumeration of the Fund's risks. Please read the Fund prospectus for other risk factors related to the Fund.

The Fund may not be suitable for all investors. Investors are encouraged to consult with appropriate financial professionals before considering an investment in the Fund.

Companies that may be referenced on this website are privately-held companies. Shares of these privately-held companies do not trade on any national securities exchange, and there is no guarantee that the shares of these companies will ever be traded on any national securities exchange.

The Private Shares Fund is distributed by FORESIDE FUND SERVICES, LLC

Summary

- Both volatility and increased market efficiency have challenged returns in conventional investment strategies, which has increased investor interest in alternative strategies, such as the private market.

- Friction has been created in the private market ecosystem by companies staying private for longer, which has helped drive expansion of the secondaries market.

- Growth in the secondaries market creates opportunities for potential new liquidity strategies. SharesPost strives to provide investors with liquidity and access to this growing asset class.

The Fund’s quarterly redemption program allows for up to 5% of the Fund’s net assets to be redeemed each quarter.

Important Disclosure

As of December 9, 2020, Liberty Street Advisors, Inc. became the adviser to the Fund. The Fund’s portfolio managers did not change. Effective April 30, 2021, the Fund changed its name from the “SharesPost 100 Fund” to “The Private Shares Fund.” Effective July 7, 2021, the Fund made changes to its investment strategy. In addition to directly investing in private companies, the Fund may also invest in private investments in public equity (“PIPEs”) where the issuer is a special purpose acquisition company (“SPAC”), and profit sharing agreements.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus with this and other information about The Private Shares Fund (the "Fund"), please download here, or call 1-855-551-5510. Read the prospectus carefully before investing.

The investment minimums are $2,500 for the Class A Share and Class L Share, and $1,000,000 for the Institutional Share

Investment in the Fund involves substantial risk. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. The Fund has no history of public trading and investors should not expect to sell shares other than through the Fund's repurchase policy regardless of how the Fund performs. The Fund does not intend to list its shares on any exchange and does not expect a secondary market to develop.

All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Fund's outstanding shares at NAV to be redeemed each quarter. Due to transfer restrictions and the illiquid nature of the Fund's investments, you may not be able to sell your shares when, or in the amount that, you desire. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. Because most of the securities in which the Fund invests are not publicly traded, the Fund's investments will be valued by Liberty Street Advisors, Inc. (the "Investment Adviser") pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees. While the Fund and the Investment Adviser will use good faith efforts to determine the fair value of the Fund's securities, value will be based on the parameters set forth by the prospectus. As a consequence, the value of the securities, and therefore the Fund's Net Asset Value (NAV), may vary.

There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments in a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities that could adversely affect the Fund’s performance. The Fund's quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so and may also result in an increase in the Fund's expense ratio. Portfolio holdings of private companies that become publicly traded likely will be subject to more volatile market fluctuations than when private, and the Fund may not be able to sell shares at favorable prices, such companies frequently impose lock-ups that would prohibit the Fund from selling shares for a period of time after an initial public offering (IPO). Market prices of public securities held by the Fund may decline substantially before the Investment Adviser is able to sell the securities.

The Fund may invest in private securities utilizing special purpose vehicles ("SPV"s), private investment funds (“Private Funds”), private investments in public equity ("PIPE") transactions where the issuer is a special purpose acquisition company ("SPAC"), and profit sharing agreements. The Fund will bear its pro-rata portion of expenses on investments in SPVs, Private Funds, or similar investment structures and will have no direct claim against underlying portfolio companies. PIPE transactions involve price risk, market risk, expense risk, and the Fund may not be able to sell the securities due to lock-ups or restrictions. Profit sharing agreements may expose the Fund to certain risks, including that the agreements could reduce the gain the Fund otherwise would have achieved on its investment, may be difficult to value and may result in contractual disputes. Certain conflicts of interest involving the Fund and its affiliates could impact the Fund’s investment returns and limit the flexibility of its investment policies. This is not a complete enumeration of the Fund's risks. Please read the Fund prospectus for other risk factors related to the Fund.

The Fund may not be suitable for all investors. Investors are encouraged to consult with appropriate financial professionals before considering an investment in the Fund.

Companies that may be referenced on this website are privately-held companies. Shares of these privately-held companies do not trade on any national securities exchange, and there is no guarantee that the shares of these companies will ever be traded on any national securities exchange.

The Private Shares Fund is distributed by FORESIDE FUND SERVICES, LLC